Intercompany can often be the forgotten child of the financial accounting function. With Virtual Trader, it no longer is.

Complying with the complex legal framework that exists for companies can be more than challenging — it can be a real pain! Compliance is an aspect of the contemporary business world that requires both external and internal organization.

On the one hand, tax authorities, regulators, and auditors must be dealt with; on the other, it’s equally important to ensure your internal teams are aligned with a coherent raft of processes and procedures.

Dealing with intercompany compliance has traditionally been a piecemeal manual process. But this approach can be particularly laborious, given the requirements heaped upon organizations in this area.

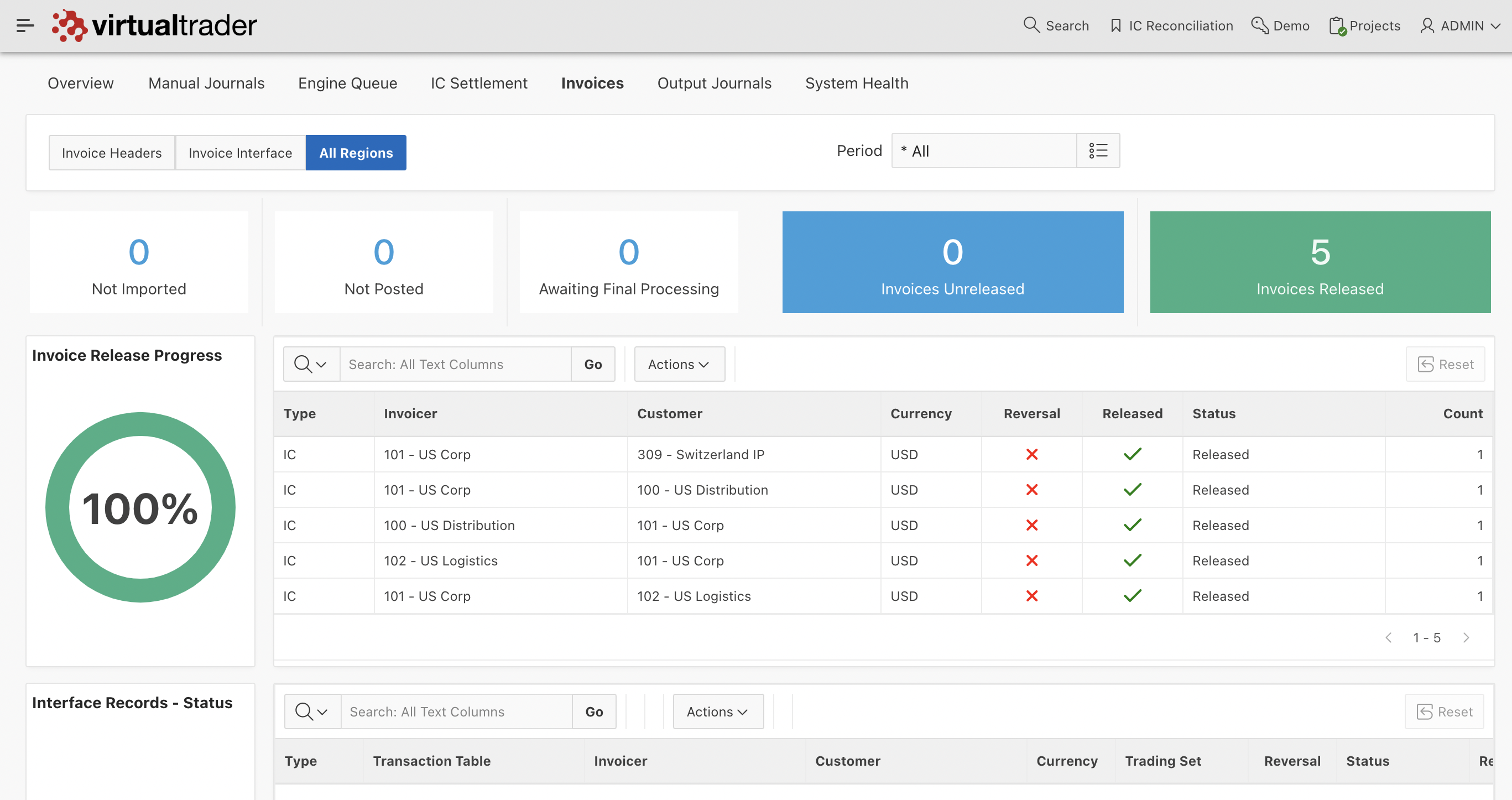

Virtual Trader offers valuable assistance with this often troublesome issue. Our automated intercompany hub replaces manual offline spreadsheets and ad-hoc processes used for managing intercompany compliance with a powerful centralized solution. This helps standardize global processes, enabling you to create and enforce a joined-up corporate policy.

And the provision of documented evidence for both transactional data and business rules will help transform your business. This information ensures you can deal with any external enquiries with ease, providing full evidence of your intercompany activity in one location. The need to scrabble around, pulling together data from different sources is eliminated — which can be a huge relief!

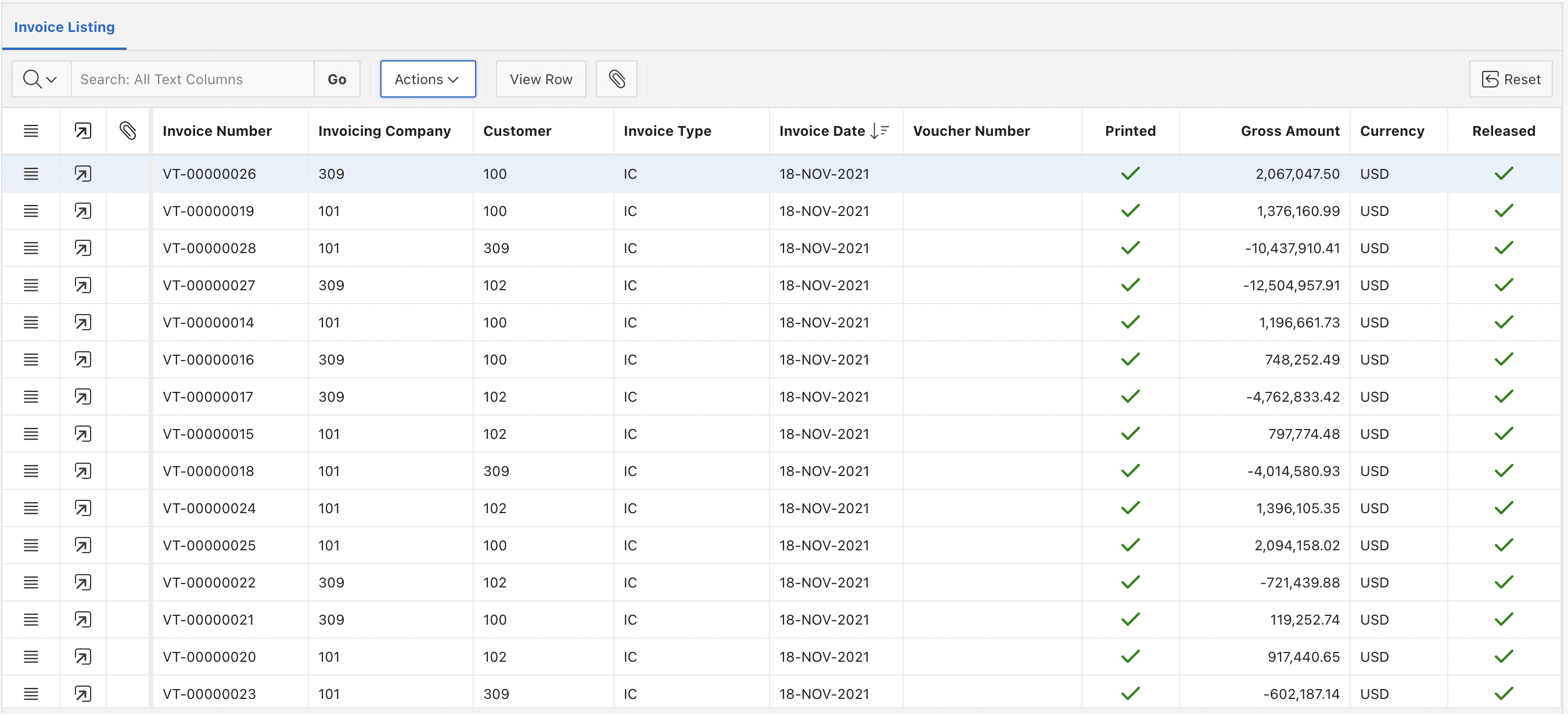

Virtual Trader is our single source of truth for intercompany invoicing and fulfilling statutory requirements. Tax, gapless numbering, voucher numbers…it's all there.

Global Apparel Manufacturer

A simple listing of intercompany transactions is no longer enough to satisfy the needs of authorities and auditors. In today's world, intercompany invoicing receives as much scrutiny as trade activity. And that's where an automated solution comes to the fore. Virtual Trader produces invoicing for all intercompany activity and can be tailored to meet differing global needs, including indirect tax details, gapless invoice number sequencing, and AP voucher numbering.

Transfer pricing agreements and calculations have come under increasing scrutiny in recent years. With authorities seeking to ensure a level playing field, performing these activities via existing offline and ad hoc processes has become riskier and prone to deeper investigation. By centralizing all intercompany activity — including transfer pricing — in a single platform across the organization, Virtual Trader adds transparency to the process. This allows supporting evidence to be retained and made readily available.

We offer a no-cost demonstration of Virtual Trader so you can experience its powerful palette of features!

US

+1 800 961 9640

US

+1 800 961 9640

Europe

+44 2476 236 990

Europe

+44 2476 236 990

Copyright © Virtual Trader